Many thanks to those who requested the written version of last week’s audio blog…here it is:

Chasing Capital Redux

I originally wrote this Blog months ago – and never published it. I wrote it before we knew what would happen with vaccine development; and before we seemingly turned the corner on this pandemic. Yet as I re-read it the other day, I wanted to publish it now anyway. Even though we know a whole lot more than we did just a few short months ago, the message here remains the same: be vigilant; be ready (for anything); and, use current circumstances – no matter what they are – to better position you, your innovation and your company for new or continuing success.

So, here goes. This is the redux of Chasing Capital…

I don’t think the question should be “How do I go about raising capital under the current circumstances?” I think the question should be “How can I use this time of disruption and quarantine to position my company for its future?”

There is a future and it’s incumbent on all of us to be prepared for it. From James McIntosh’s April 12th Streetwise opinion column in the Wall Street Journal: “The coronavirus pandemic will eventually be behind us, maybe soon, maybe not. Either way, the scars will long persist for an entire generation of investors and future managers now living through what is rapidly becoming the deepest downturn since World War II.”

But there remains a future and it’s a future for which we must prepare. So when startups ask me what to do, I respond with questions for them to think about. I will share those questions in a moment, but let’s first recognize that investors – small and large – have all pretty much hit the pause button waiting to see where this thing is ultimately headed. Prior commitments are, by and large, being honored. But let’s be realistic, investors will be looking to protect their existing portfolio companies – so we will likely see more bridge rounds by pre-committed previously-invested sources of capital and fewer new investments. Valuations will soften due to larger market forces – so be prepared for that in future rounds. But most immediately, do everything in your power to extend your runway. How? Ask yourself these questions.

Have you enhanced your ability to cut operating costs? Have you converted fixed costs to variable costs wherever possible? Have you strengthened your balance sheet? Do you know your operating cost leverage points? Have you opened a dialogue with customers and vendors about adjusting terms – to help your company and theirs? What can you do without? What can you defer?

Have you examined your underlying business model to reflect your new normal? Is that reflected in your business plan? Surely, you’ve already revised and re-revised your business plan to reflect the constant changes and challenges we face. Keep it current and realistic. Can you pivot to an immediate new product NOW? Can you get a new customer NOW?

Have you explored where you can get immediate help? Are you prepared to quickly apply for help? Are you talking to your current investors regularly? Can you use this time to institute a regular and frequent update to all your constituents? Don’t be afraid to ask for help!

Are you looking after your teams’ collective and individual well-being? How can you help your staff generate personal income? Can your team fill in the gaps left by prior outsourced functions?

Imagine the day in the near-term future when you are in front of a potential investor, a potential new customer, or even a potential new team member: How will you answer them when they ask “What did you do during the crisis to enhance your company’s future?”

And that is how I concluded Chasing Capital. Maybe investors didn’t really hit the pause the button – at least not for long. But, the concluding question I asked remains as pertinent today as it was six months ago. In fact, it’s timeless regardless of circumstances. “What have you done to enhance your company’s future?”

There will always be another calamity; another circumstance. Be ready for anything.

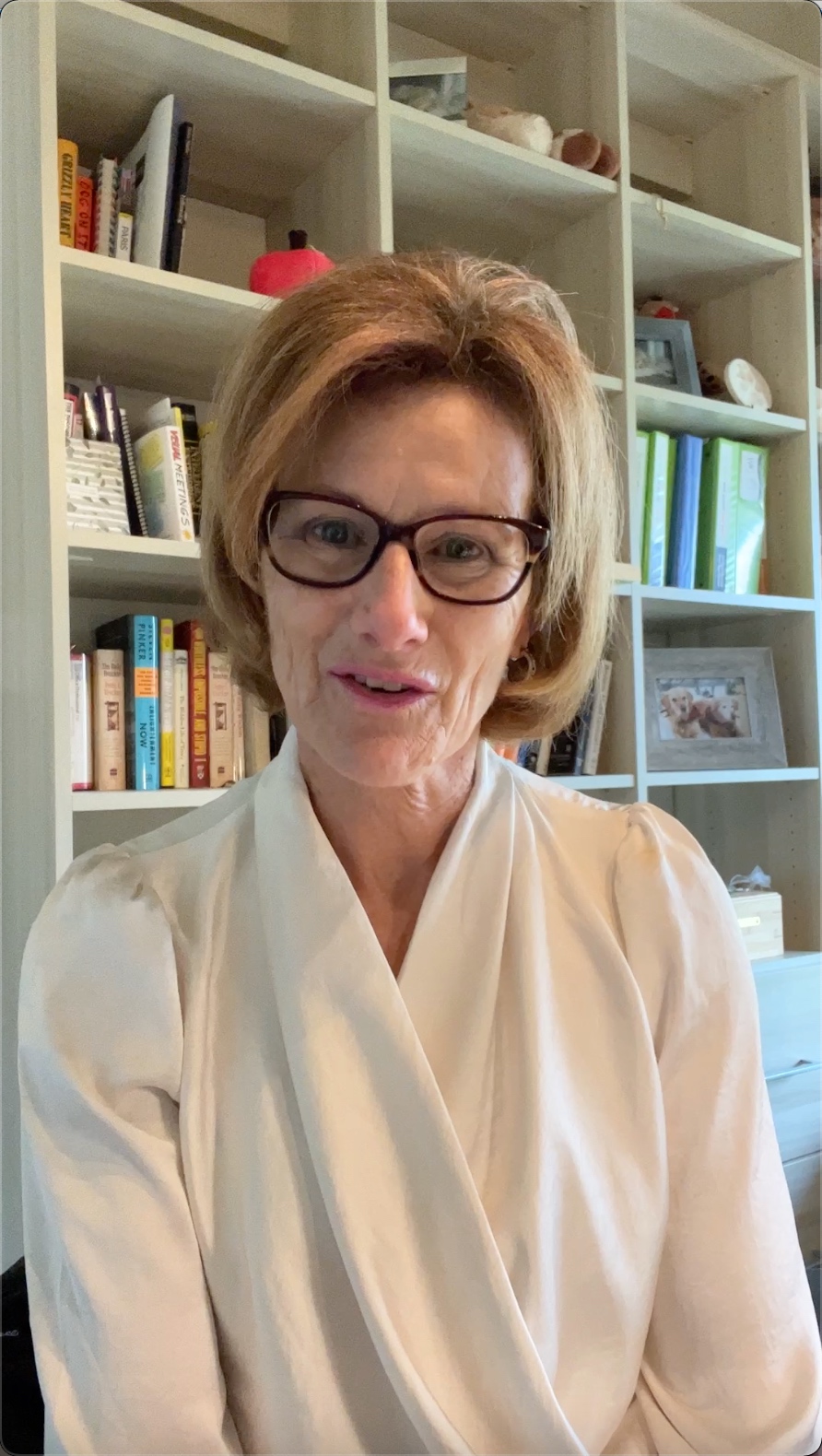

Please join me on this podcast as I share my perspectives on raising startup capital in challenging times. John Hanak.